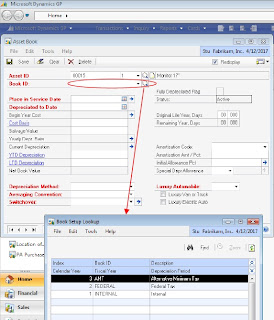

1. On the Cards menu, point to Fixed Assets, and then click Book.

2. In the Asset ID field, enter the appropriate asset ID.

3. In the Book ID list, click the appropriate book ID.

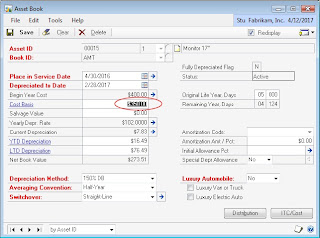

4. Reduce the value in the Cost Basis field by the credit memo.

5. Click Save.

6. Click Yes when you are prompted to continue.

7. Because the Cost Basis field is a depreciation‐sensitive field, click one of the following Reset options when you are prompted:

6. Click Yes when you are prompted to continue.

7. Because the Cost Basis field is a depreciation‐sensitive field, click one of the following Reset options when you are prompted:

- Life: Calculates depreciation from the date it was put in service through the date that the asset was already depreciated. Adjustments to the depreciation for any period are saved and displayed in the Asset Book window.

- Year: Calculates a new yearly depreciation rate and uses the new rate to recalculate depreciation from the beginning of the current fiscal year as defined in the Book Setup window through the date that the asset was already depreciated. Adjustments to the depreciation for any period are saved and displayed in the Asset Book window.

- Recalculate: Calculates a new yearly depreciation rate as of the beginning of the current fiscal year as defined in the Book Setup window. However, calculations are not based on the new rate until the next time depreciation is taken on the asset. The current year‐to‐date depreciation amount is not affected.

No comments:

Post a Comment